This procedure is a sensible choice if you don’t have the need to protect low invoice amounts due to the low risk involved. With Selective Factoring, you decide which claims to assign to us by selecting the invoices that should continually be pre-financed and guaranteed.

#Invoice factoring solutions full#

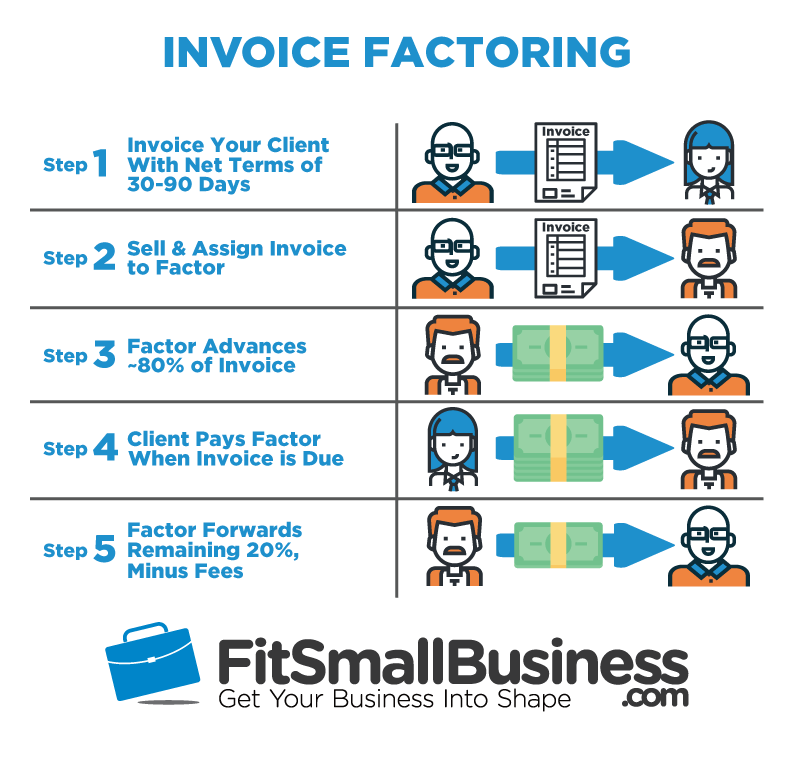

Upon full payment of the invoice, the factoring company gives the. The factoring company is then responsible for collecting the invoice payment from the client. This simplifies your finance planning substantially. Invoice factoring is a type of financing in which a business sells its unpaid invoices to a specialized factoring company and receives most of the moneytypically 80 to 90upfront. It can take anywhere from 30 to 90 days for most businesses to receive payments from their customers, which is a long time when you have immediate business needs and employees to pay.

#Invoice factoring solutions professional#

This variation is suitable for companies with their own professional credit control department.

Special programs for freight brokers and trucking companies. We offer four types of factoring: full-service factoring, in-house factoring, maturity factoring and selective factoring. Our invoice factoring company offers: Factoring of full-service non-recourse accounts receivables.

0 kommentar(er)

0 kommentar(er)